There is always a need for some cash in your accounts. For short-term needs, you need a cash float in your checking account to cover bills paid between paychecks, and for unexpected events, you likely need cash investments to serve as an emergency fund.

In an investment account, cash can build up from new contributions, dividends, and interest payments. During periods of volatility, cash can accumulate if you hesitate to invest or even take a step back by selling a portion of your portfolio.

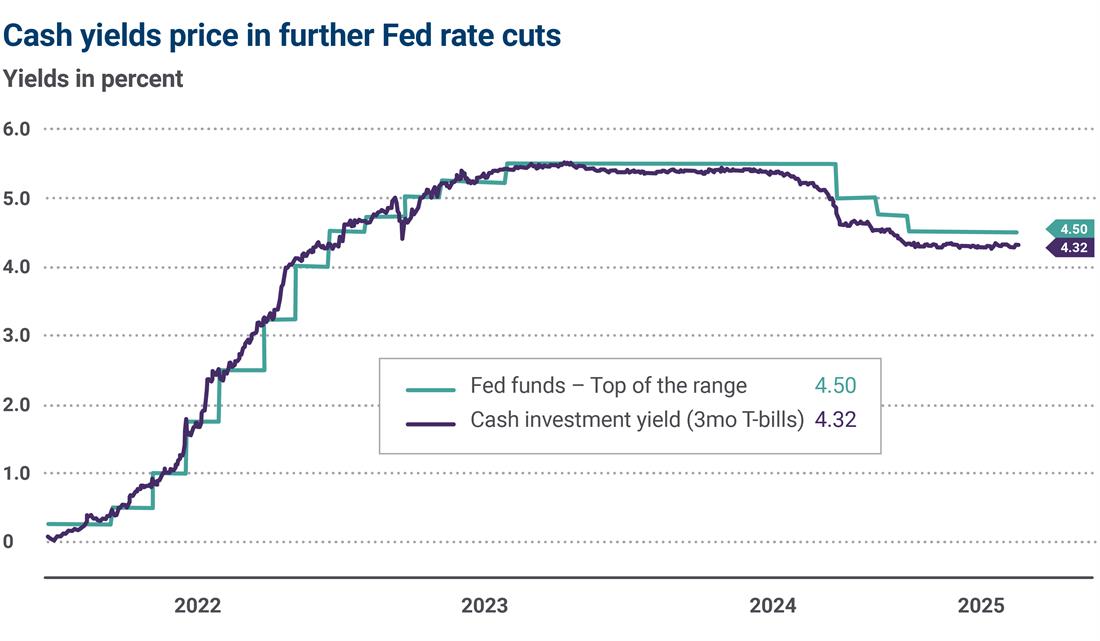

Cash and cash investments earned roughly 5% in 2023 and 2024. The Fed’s rate cuts, which began last September, have already shaved a full percentage point from the typical cash investment yields. Three-month T-bill yields, a proxy for cash investment returns, settled to 4.32% on May 6, down from a peak of 5.51% on October 6 of 2023.

Source: Bloomberg L.P., as of 5/6/2025. These figures are shown for illustrative purposes only and are not guaranteed. They do not reflect taxes or investment/product fees or expenses, which would reduce the figures shown here. Past performance is not a guarantee of future results.

More Fed cuts ahead could pull the rug out from under cash

The potential for slower growth and increased labor market slack in the months ahead suggests that the Fed may continue lowering policy rates. Our forecast envisions another full percent of cuts in the second half of this year.

Similar to last year, we anticipate Fed policy rates dragging cash investment yields lower, taking the shine off of holding higher cash levels, especially in portfolios supporting medium- to long-term investment goals.

The cost of waiting to invest

Whether it is delaying putting a new chunk of dollars to work in an investment account or pulling back from the market at times of volatility, those who delay could miss out.

The cost of waiting may include missing out on cash investment yields if rates drop. Waiting could delay investments in fixed income with potentially higher yields now compared to the future, or in stocks at potentially lower prices.

Design a strategy where you can remain invested long-term in a diversified portfolio

Investors who dial in the proper mix of stocks and bonds could be more successful than those who sell investment assets to lower risk after a market sell-off occurs.

To do this, consider the level of price volatility you can bear and set the mix of stocks and bonds accordingly. By gearing around the correct risk tolerance, you can remain invested and avoid missing out on performance that could be the difference in reaching an investment goal or falling short.

One strategy is to automatically reinvest dividends and interest where possible to keep investment dollars working for you. Many mutual funds enable automatic reinvestment to do just that.

Take a buy-and-hold approach to bonds to help lower volatility

While it is easy to convince ourselves that we’ll be ready to buy if the market goes on sale, reality is often different. The market typically drops when economic and corporate conditions start to look murky; rather than jumping into the markets according to plan, you may be tempted to wait until the storm passes.

A buy-and-hold approach to fixed income may be an old-school strategy, but a sound one when yields are high on a historic basis. The lower level of risk and volatility on high-quality fixed income often lends itself well to this approach, compared to a portfolio of small cap stocks filled with evolving risk accompanied by lots of volatility. A buy-and-hold approach also takes advantage of the unique feature of bonds – their maturity.

At an individual bond level, buying a two-year bond at a 5% yield to maturity and holding until it matures results in a 5% total return. The logic works the same with a portfolio of bonds or a bond fund held long-term.

By committing to buy and hold bonds, you may be able to lower the market risk of prices moving around. This approach also provides a steady stream of income or returns from bond investments.

We believe there’s an opportunity to put excess cash to work in fixed income today to lock in investment returns beyond the near term and capture relatively elevated yields still available. Now may also be a great time to put monies taken out of the market due to recent volatility back to work in high-quality fixed income that can offer moderate returns with less risk than stock investments.

Talk to an Ameriprise financial advisor about your investment strategy

An Ameriprise financial advisor can help ensure your portfolio’s asset allocations are aligned with your risk tolerance to help you meet your long-term goals.