Your retirement could last several decades, so it’s important to not let taxes diminish your savings more than necessary. One way to safeguard against this is through implementing a strategy called tax diversification that spreads out your investments across various tax treatments over a long period.

Here’s how tax diversification can potentially help you keep more of your hard-earned retirement savings:

What is tax diversification?

Tax diversification is a strategy that takes into consideration various tax treatments across the investment accounts you will eventually use for income in retirement. Because different types of accounts and investments offer specific tax advantages, you can gain more control over your taxes by placing your investments in a variety of accounts. When coupled with a tax-efficient withdrawal strategy, tax diversification may help your assets last longer in retirement. Taxation is just one consideration when making investment decisions.

How tax diversification works

There isn’t a one-size-fits-all approach for tax diversification. We’ll work with you and your tax advisor to make personalized recommendations based on your financial goals, time horizon, account mix and tax situation.

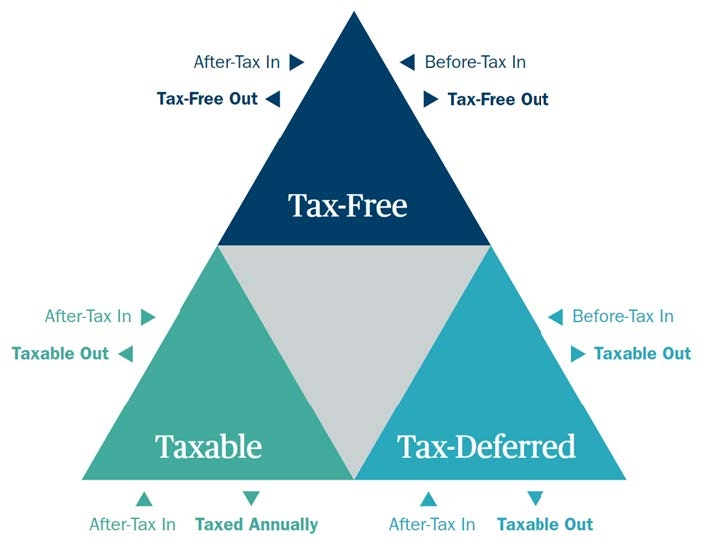

We will review your investment accounts through the lens of the three different types of tax treatments — taxable, tax-free and tax-deferred — and help you decide how to strategically allocate your assets among them.

The idea is to diversify your retirement funds among different account types during your working years as you save for retirement. There are a couple ways to achieve this: You can diversify as you save, and you can also move investments in and out of the different types of accounts after you have saved into them. However, moving investments in and out of a taxable account can have tax consequences, while moving investments in certain retirement accounts, like traditional or Roth IRAs, may not.

Breaking down the different tax treatments:

|

Tax treatment

|

Taxable

|

Tax-free

|

Tax deferred

|

|

How contributions are taxed

|

Contributions made with after-tax dollars

|

Contributions made with after-tax dollars

|

Contributions made with pre-tax or post-tax dollars8

|

|

How earnings are taxed

|

Taxable income, including capital gains when realized, interest when received or dividends when paid1

|

Earnings can be tax free, provided certain conditions are met

|

Money grows tax deferred. Distributions are generally taxed at ordinary income rates8

|

|

Account examples

|

Mutual funds, stocks, bonds, bank accounts2

|

Roth IRA, 3,4 Roth 401(k),3,4 529 plan,5 municipal bonds,6 cash value life insurance,7 health savings accounts

|

401(k),3 403(b),3 457(b), traditional IRA,3 pension plans,3 annuities3

|

|

Potential reasons to contribute

|

You want more flexibility for when you can withdraw your money and don’t want to consider required minimum distributions (RMDs)

|

You want to withdraw money in retirement without being pushed into a higher tax bracket

|

You anticipate you will be in a lower tax bracket during retirement. Taxable distributions are generally taxed as ordinary income upon withdrawal8

|

What are key benefits of tax diversification?

In general, many investors gravitate toward tax-deferred accounts — such as a 401(k) — and thus, tend to be overweighted in investments that will be taxed in retirement.

By diversifying your investments across all tax treatments, you can:

- Take more control of your financial picture, now and in retirement. Taxable and tax-free accounts, do not have distribution requirements, allowing you to control when and how much you take. Tax-deferred qualified accounts generally require distributions at age 739, but you control distributions from tax-deferred accounts before age 73 and amounts you take over the RMD.9

- Potentially fuel savings over time and help your assets last longer. Being able to choose which assets are used to create your income could allow you to spread your taxable distributions over more years so you pay less in taxes and keep more of your savings.

- Gain flexibility in how you access retirement income in the future. Life events are likely to change your savings and income needs in the future. Diversifying your savings among these different tax treatments will give you greater flexibility as life events, both expected and unexpected, occur.

When should an investor consider tax diversification?

Some opportunities may exist to diversify your tax situation during retirement, but in many cases tax diversification should be done over time. The sooner you consider how and when your retirement assets are taxed, the more time you have to make adjustments and accrue any potential benefits.

Let’s assume a 25-year-old investor at the start of his career expects his income in retirement to be much higher than what he currently earns. In this example, it may make sense for him to prioritize saving for retirement in a Roth IRA while his income is at lower rate (and he is still eligible to contribute). Though he will pay taxes on his Roth IRA contributions now, he won’t pay taxes on the distributions in retirement, when his tax bracket could be higher. For this investor, understanding the dynamics of tax diversification early in his career may lead to reduced taxes and longer-lasting assets in retirement.

Keep more of your money – get started today

Let’s connect – we’ll assess the tax diversification in your current savings strategy and look for opportunities to help you keep more of your retirement funds.