Anthony Saglimbene, Chief Market Strategist – Ameriprise Financial

This article is intended to provide perspective on how potential election outcomes may impact financial markets and investments. These insights are not political statements from Ameriprise Financial, nor an endorsement of a particular candidate or political party.

On Nov. 5, Americans will head to the polls to elect the next President of the United States and their representatives in Congress. Leading up to then, investors can expect to be inundated with political advertisements, campaign speeches, extensive cable news coverage and a barrage of commentaries on the agendas of the two main political parties.

However, while the political noise can feel overwhelming, history shows that presidential elections, alone, are generally not a significant driver of asset prices over the long term. Rather, factors like economic growth, corporate profits and interest rates are more likely to drive — or detract from — growth in the stock, bond and financial markets.

Still, this year’s likely presidential nominees have notable fiscal policy differences that investors should understand. Here’s a look at those key differences by category:

Tax laws

Given the U.S. debt level currently stands at around $27.5 trillion and counting (not including Social Security Trust Fund “IOUs” and other inter-government obligations), policy approaches to tax and spending initiatives out of Washington are becoming increasingly important to investors.

In a second term under President Biden, investors might expect his administration to look for ways to influence/modify several provisions that expire next year within the Tax Cut and Jobs Act of 2017. To pass the tax cut legislation, Congress used the reconciliation process, which made corporate tax cuts permanent but required a sunset for other major elements of the law, including marginal income tax rates for individuals and estate tax exemptions. At the end of 2025, these elements will reset. Under a second term, President Biden may allow these provisions to expire but extend tax reductions for households making under $400,000 a year. To pay for this change, a Biden administration may seek to impose new taxes on wealthy individuals, increase the corporate tax rate, or lift taxes on stock buybacks.

In a second term under former President Trump, investors could expect his administration to push for making those expiring tax elements permanent. However, extending such provisions will likely come at a cost. According to the Committee for a Responsible Federal Budget, extending expiring provisions in the Tax Cut and Jobs Act would cost $3.5 trillion through 2035. A Trump administration could also look to reduce taxes on individuals and small businesses, permanently allow the immediate expensing of investment spending, and ensure that the U.S. corporate tax rate is globally competitive.

Importantly, both administrations will be subject to the makeup of Congress following the election, and a result that leads to the continuation of a divided government may severely limit what a Biden or Trump administration can accomplish when it comes to changing tax laws.

China

Investors should also expect both presidential candidates to remain tough on China but to differing degrees. While President Biden has largely left in place tariffs former President Trump initiated under his presidency, Biden has further sought to limit China’s ability to access advanced U.S. technology/semiconductors. If Biden were re-elected, we would expect the administration would continue to limit China’s access to U.S. technology (especially in the artificial intelligence space) while influencing other nations to take a similar approach. A Trump win in November could see his administration continue Biden’s approach of pressuring China on technology, ensuring the enforcement of the Phase One Trade Agreement, and maintaining elevated tariffs on Chinese goods. Regardless of who sits in the White House next January, expect either Biden or Trump to seek ways to strengthen U.S. dominance in technology and manufacturing, which could keep friction points with China elevated over the coming years.

Corporate and regulatory impact

Investors should expect other key policy differences under a Biden or Trump presidency that, on the margin, may influence financial markets. In a second term, President Biden could continue to focus on regulations that limit large corporate mergers and acquisitions while pressing for clean energy initiatives. We suspect a Biden administration could also look to increase regulations across Big Tech and the financial industry. Conversely, in a second term under Trump, border security and prioritizing an energy policy that could further push the U.S. into greater energy independence could be top priorities for the administration over the coming years. Notably, under both Trump and Biden, the U.S. has increased oil and gas production over a number of years and has become a net exporter of both.

Stock market

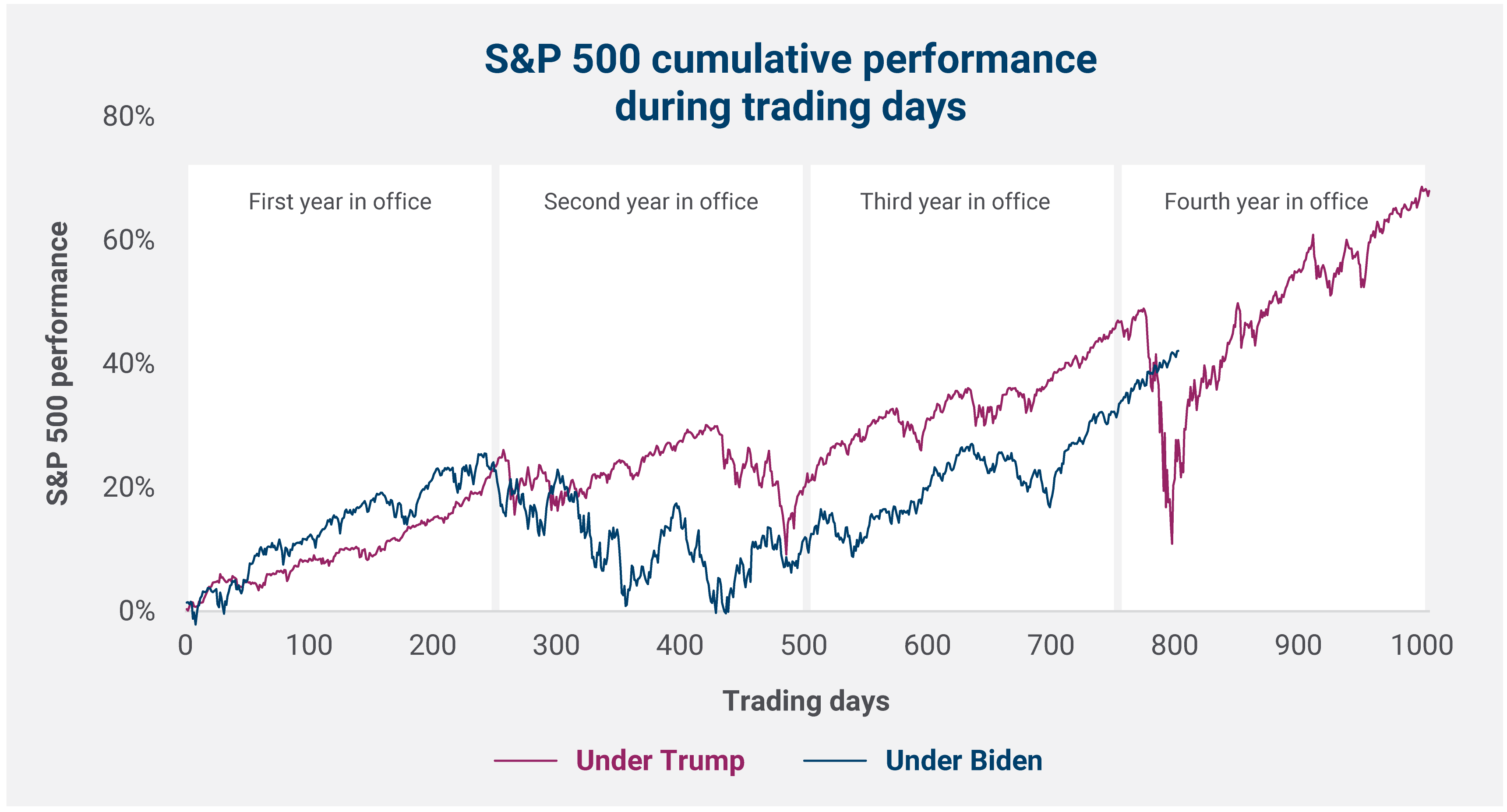

From a market perspective, U.S. stocks have performed well under both administrations. As the chart below shows, under both Trump and Biden, the S&P 500 Index has climbed higher. Over their terms in office, the S&P 500 has weathered a trade war with China, changes to tax laws, a global pandemic, extraordinary policy responses to COVID-19, global supply disruptions, record high inflation, elevated interest rates and the transition to a more normalized environment.

Bottom line: While this year’s election could drive some near-term volatility in stocks as we move closer to November, the market has dealt with and persevered through dynamics much more uncertain and disruptive to macroeconomic conditions than who the next president will be.

Sources: Bloomberg and American Enterprise Investment Services. Biden returns through 3/31/24. This example is shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

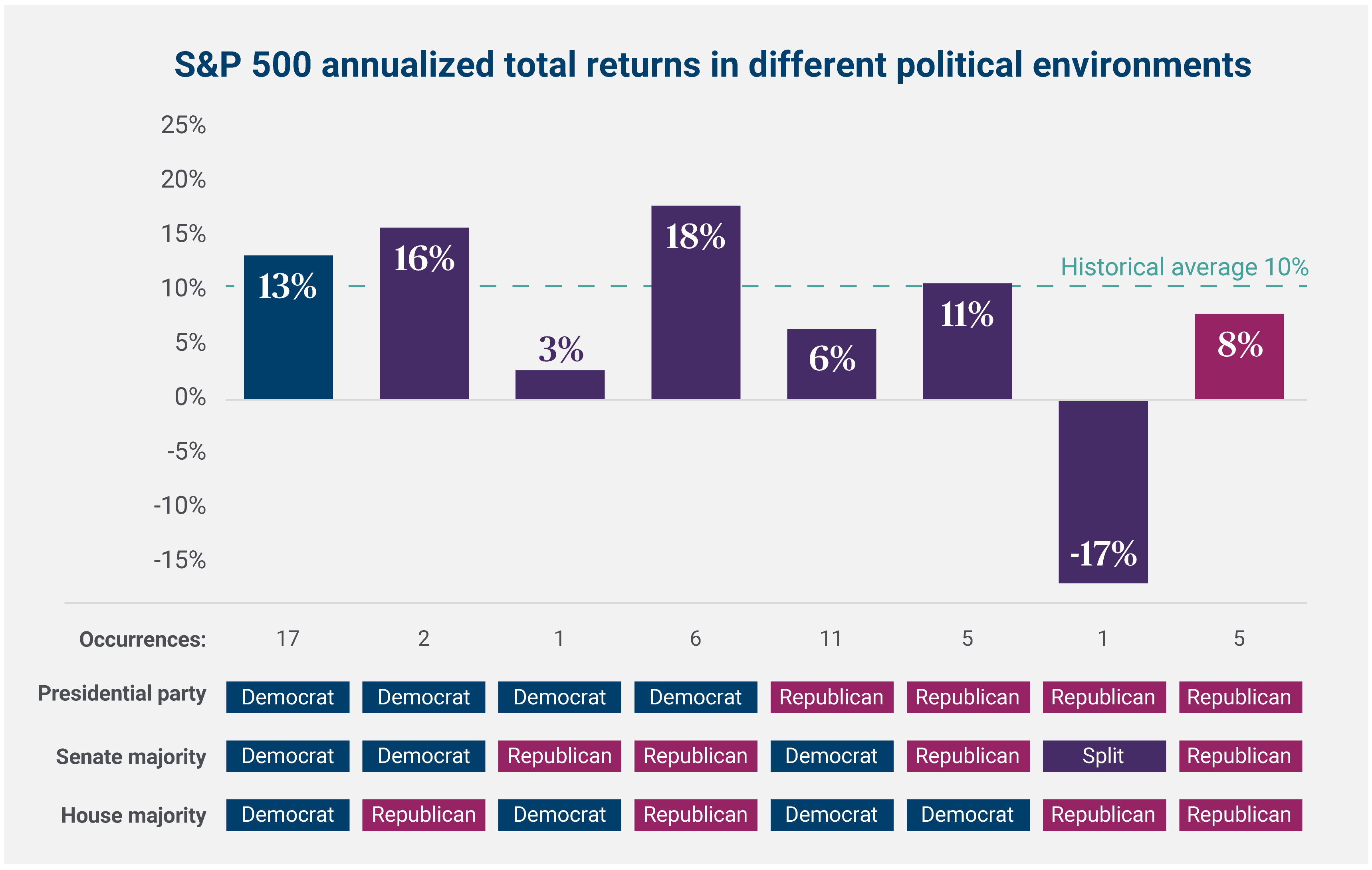

While much of the election focus this year will fall on the presidential race, financial markets generally take a more holistic view of elections. Control of Congress and whether one party gains the edge in Washington following the November election could also play a key role in how markets respond to this year’s results. However, as the chart below shows, markets have historically responded well to a divided government. A split government between Democrats and Republicans helps limit Washington’s ability to make large changes to fiscal policy and/or tax codes. While a divided government isn’t necessarily the best long-term option for addressing the serious issues regarding the current state of U.S. debt and deficits, investors tend to favor the status quo if they can count on the “rules of the road” remaining largely unchanged after an election.

Sources: Bloomberg and American Enterprise Investment Services. This example is shown for illustrative purposes only and is not guaranteed. An index is a statistical composite that is not managed. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

Bottom line

In our view, investors should keep their primary focus on the pace of economic and profit growth for this year, as well as changes in expectations around inflation and interest rates. Overall, we believe the macroeconomic backdrop remains supportive of higher stock prices this year. In the background, stocks may see some additional volatility as the election draws closer and as investors attempt to discount the results. However, the market generally looks past elections and quickly recenters on the fundamentals that drive asset prices longer-term.

Don’t let the political noise distract you from your investment strategy

Your investment portfolio should be built to weather different political and economic cycles. If you have any concerns about the market impact of the upcoming U.S. elections, reach out to your Ameriprise financial advisor.